As we welcome 2024, it’s time to reflect on the economic and financial landscape of 2023 and look ahead to what this year might have in store. At Whelan Financial, we believe in providing you with valuable insights to make informed decisions. Let’s delve into the key components of the financial world in 2023 and provide you with a glimpse of what the future might hold.

The U.S. Economy in 2023

2023 seemed destined to be defined as a year of uncertainty but was instead defined by resiliency.

Heading into 2023, there were major questions about the effects of inflation and interest rates on the economy. Despite these challenges, consumers continued to spend, companies continued to hire and our economy continued to expand.

These positive factors allowed the Federal Reserve to bring inflation down over the course of the year without creating undue economic stress. In fact, as inflation came down and our economy continued to expand, it provided investors with confidence to purchase back into risky assets, such as stocks.

The Stock Market in 2023

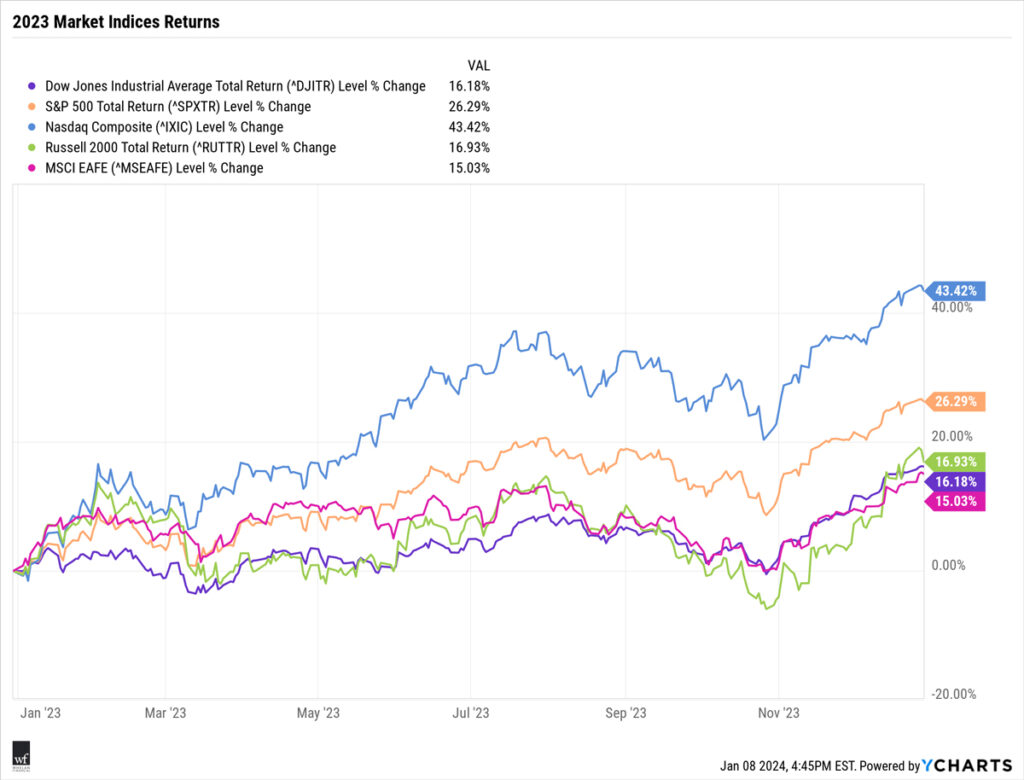

The stock market in 2023, as measured by the S&P 500, was up over 26% by year-end. Volatility was a constant companion as investors grappled with economic uncertainties, especially after the failure of Silicon Valley Bank in early March. However, improving fundamentals in the economy provided an improving investment landscape as the year moved forward, leading to gains of double digits for major indices.

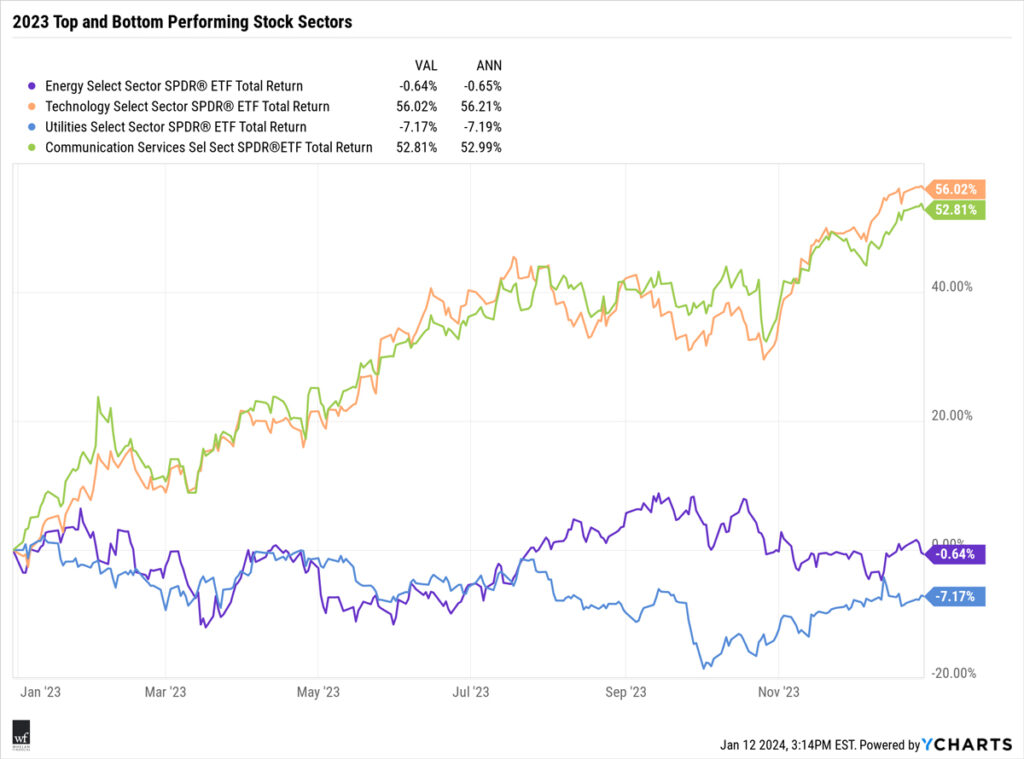

The top performing sectors were positively impacted by declining inflation as technology and communication services reported gains of greater than 50% for the year. Sectors that lagged included energy and utilities, which were among the top performers in the inflationary environment of 2022.

Top performers: Technology and Healthcare sectors

Bottom performers: Energy and Utilities sectors

The Bond Market in 2023

In the bond market, 2023 was marked by shifting yields and interest rate expectations. As inflation concerns persisted, bond yields fluctuated, impacting fixed-income investments. The Federal Reserve’s decisions on interest rates were closely watched, and their gradual tightening contributed to bond market fluctuations.

Bond yields peaked in October and then gradually declined as the market digested inflation and economic data. The yield curve is still inverted, with short-term yields higher than long-term yields.

The new, higher, rate of interest has provided investors the opportunity to purchase short-term treasuries, CDs, and money market funds that produce income of over 5% on an annual basis. This floor of income production is higher than what’s been available to investors for over 15 years.

Market Outlook for 2024

As we look ahead to 2024, there are several factors that could shape the financial landscape. Inflation remains above the target rate, and the Fed’s actions may continue to influence market dynamics. Geopolitical tensions and global supply chain issues may introduce additional uncertainties.

At Whelan Financial, we are committed to guiding our clients through these challenges. Our experienced team will continue to monitor market trends, adapt investment strategies, and provide you with the guidance you need to achieve your financial goals in the year ahead. Contact us today to learn how we can assist you in making the most of your investments.

Authored by Taylor J. Whelan, CFP®

*The written portion of this blog was composed with the help of generative AI. Preliminary language, parameters, and edits were made by the Whelan Financial team and Taylor J. Whelan, CFP®.